How to create, grow, and fund a tech startup: an operational framework

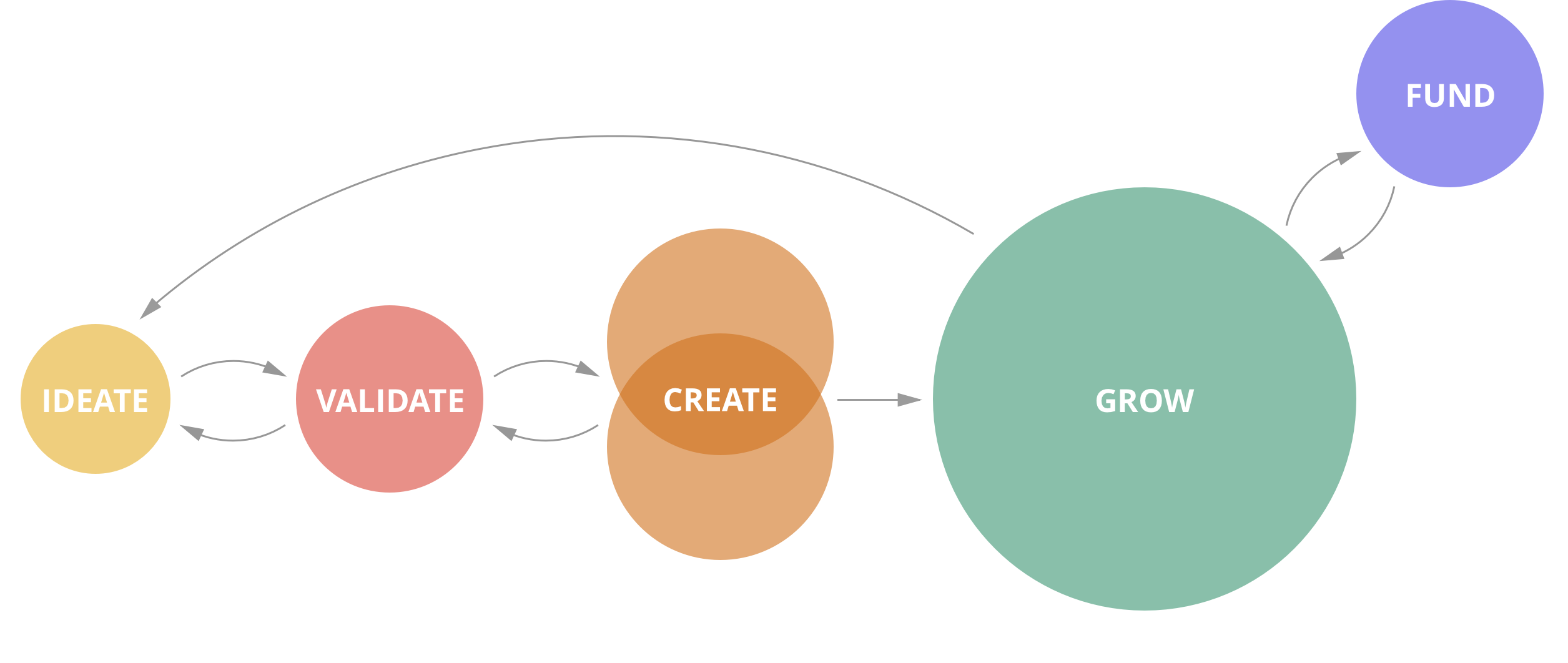

Throughout the course of co-founding, advising, and investing in startups over the past couple of decades, my partners/advisors and I at Prota Ventures have developed the following practical operations framework to help founders through the early stages of startup life:

It's important to note that the basic order described below matters. We've learned the hard way, multiple (multiple) times, how doing things significantly out of order leads to miscommunication, wasted time/money, and unnecessary chaos.

That being said, it's a cyclical process and many steps can be worked on in parallel, just don't get too far ahead and leave other team members behind.

These articles were published in early draft form below and will be turned into an upcoming book. Subscribe to my newsletter and I'll keep you posted on publication details.

Also, my partners and I have built a web app to guide founders through this framework. Sign up for free here.

Here's the basic outline

Ideate

- The Idea (vision, problem to solve, product details, value & growth hypotheses)

- Overview Statement (boiling down vision, problem, and solution)

- The Market (competition, “why now”, addressable market)

- Customer Segments / Profiles / Personas

Validate

- The Team (who is doing what, exactly)

- Surveys

- Interviews

- Advisors

- Experiments (low-cost validation)

Create

- The Roadmap (timeline of sprints & milestones)

- Overview Story (rough collection of initial user stories)

- Funnel Stages & KPIs

- UI Spec

- Tech Stack Decisions

- Data Architecture

- UX Flow Chart

- Brand Foundations

- Name

- Logo

- Legal stuff (corporate structure, team comp agreements, terms & conditions, trade names)

- Financial stuff (financial model, where the initial $$ is coming from)

- Style Tiles

- Wireframes

- Mockups (do as few as possible here)

- Prototype (html/css/javascript; pages/views/components)

Grow

- Private Alpha (i.e. make it a functioning product on a staging server)

- Coming Soon Stage (email queue)

- Private Beta

- Public Beta

- Initial Iterations (product and company)

- Exploring Product-Market Fit

Fund

- The Friends & Family Round

- The First Outside Round, navigating accelerators, angel investors, and venture capitalists

- The Pitch (how/when to use the Deck, 1-pager , etc.)

- Closing your first round and communicating with investors (leveraging their skills and networks)

Foundational mistakes will affect your ability to raise money

Mistakes and bad habits formed during the foundation-setting process are costly. For example, most savvy investors (even in your pre-seed and seed rounds) will take a careful look at not only your team, product, and market, but also at often-overlooked things like your financial model and cycle times within your funnel metrics. Unless you have a validated hypothesis of who your customers are, and can explain in detail how you will continue to acquire them successfully, it will be difficult to land funding.

I've up these steps because I've met - and keep meeting - a growing number of entrepreneurs who are repeating similar mistakes, running into the same brick walls, and are having trouble getting into accelerators or finding success with angel investors and/or venture funds.

While there is no lack of content out there for all these steps above, I have yet to find a concise resource that ties them all together (if you know of any, let me know). I hope you find these chapters helpful.

Author's note: as I mentioned above, feel free to subscribe to my newsletter and I'll let you know about publication details for this upcoming book. Thanks!

Startup Rocket

We help entrepreneurs ideate, validate, create, grow, and fund new ventures.

Based on decades of startup experience, our team has developed a comprehensive operations framework, a collaborative online tool, and a personalized coaching experience to help take your business to the next level.